GTA REALTORS ® Release February 2026 Stats

Thursday Mar 5th, 2026

Share

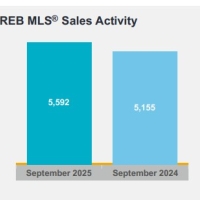

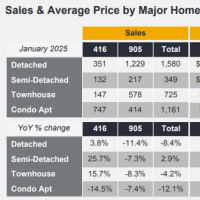

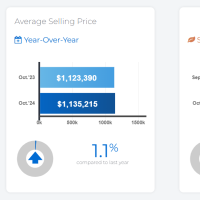

GTA REALTORS Release February Stats Greater Toronto Area (GTA) resale housing market conditions tightened in February 2026 compared to February 2025. While sales were down year-over-year, new listings declined by a greater annual rate. The dip in new listings is in line with recent polling results from Ipsos which show listing intentions are down for 2026. “Many would-be homebuyers are waiting for selling prices to level off before moving into the market. If new listings... [read more]